Image source: http://services.iadb.org/wmsfiles/images/0x0/pillars-fixed-24000.jpg

PILLAR TWO

Unless there are guaranteed outcomes and they're distinct and compelling adequate, folks usually don't need to choose up a e-book turn off the tv, go to workshops and gain knowledge of anything new, namely no longer for anything less than millions. And they need it quick too!

So, how do you gain knowledge of Financial Intelligence? I want to think about of Financial Intelligence as a platform on which you build your wealth. And like several platform, it needs to have a durable fortify, which I consider of as....The Four Pillars of Financial Intelligence .

These are the passive revenue streams that you will eventually continue to exist, but in the brief term they might be re-invested to get thecontinual of compounding called by Einstein the "Ninth Wonder Of The World" to be just right for you instead of against you.

Think instead "how could I have adequate money it?"

PILLAR ONE

Pillar Four is "Growing Your Money" - gaining knowledge of how to soundly and, extra importantly, QUICKLY grow your extra revenue flows to decent sized FURTHER passive streams of revenue for you. We are no longer talking about the paltry rates of interest payable by banks and building societies here, oh no. (I chortle out loud when I see the banks launch a 5% interest rate deposit account with such fanfare!)

Actually, on that topic, do you recognise that statistically speaking, you have extra probability of an aeroplane landing on you than winning the Lottery? And that the usual in the UK is a spend of 15 a week on the Lottery? If you took that 15 for twelve months, and invested it at 20% per annum, it'd DEFINITELY be worth 29,903 in twenty years.

Oh, yes, you ARE allowed to share your wealth! What a chortle!

PILLAR FOUR

How does this one work? This is where you pull your money out again and you nonetheless carry on earning passive revenue streams on the unique investment.

NO !!!!

But if you KEPT placing in your 15 a week it'd only take you 11 years to make an analogous money. And only 30 years to make you 1.1 million.

Pillar Three is "Make More Money" and this involves the realisation that you must always never just depend on your job (JOB = just over broke do not forget that) for your only alleviation of revenue. When I talk to parents about creating other streams of revenue apart from their job, they frequently consider that I'm talking about working in a pub or stacking cabinets in Waitrose in the evenings. Not at all, I wouldn't insult you by suggesting such a factor.

No, we're talking about investing your money in the "Supermodels" of the Investment World vehicles that return a minimal of 20% per annum and then on to the "Big Daddy" which is when you get an infinity return on your investment.

And relying on just your pension for your revenue when you retire, when your pension is invested in the stockmarket (a good number of folks "in the recognise" thinks that there is a massive slide coming in the importance of shares towards the finish of this decade) .....that's risky!

With that thought I will leave you and hope that I've managed to get you excited about enhancing your Financial Intelligence with a view to making genuine, lasting wealth in your existence and that of your loved ones.

Which means that it's possible you'll put your pot of cash to be just right for you again and again and again, creating extra and extra passive revenue streams for you and you might even see the snowball consequence this can create. I have some marvelous chums that used an analogous (small) pot of cash to build a property portfolio of over 250 properties, worth 37 million, within 10 years.

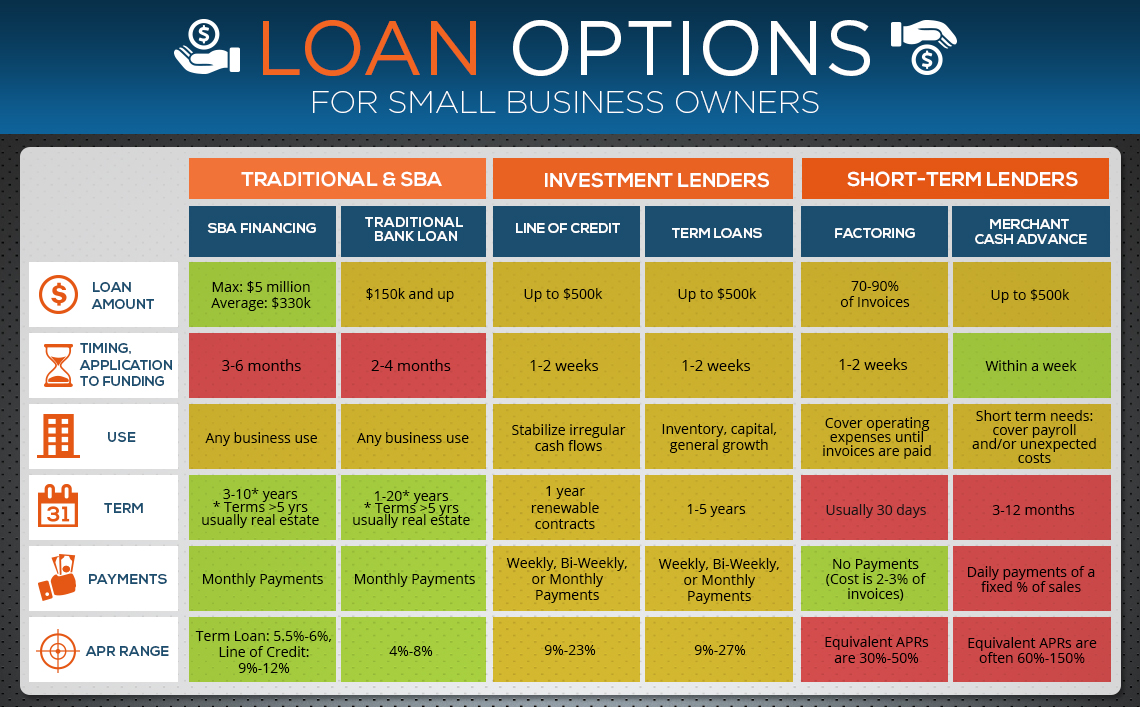

Pillar Two is "Managing Your Money" and covers budgeting, cashflow management and projections, credit management and debt busting. Knowing the difference between just right debt and bad debt (and if you do no longer recognise the difference then you definately need to read "Rich Dad Poor Dad" by Robert Kiyosaki rapid!).

If property is appreciating at a median of 10% per annum (and in our part, traditionally it's a strategies going to be been 14% per annum) it's possible you'll work out for yourself what passive revenue THAT portfolio is generating per annum. Well, in my case it's possible you'll if you have a calculator or a telephone!

Being able to compare varied investments like for like and even compare a property investment to a business investment, and a stock marketplace investment to an investment in an internet business, is a mandatory ability we will teach you in the Money Gym.

I'll come back to the young little toddlers inheritance later.

Anyone who knows me knows that I tremendously want to talk about Financial Intelligence in preference to Wealth Creation, but it's a strategies going to be just no longer just right marketing. Wealth Creation just sounds such a lot extra sexy, doesn't it?

Pillar One is "Managing Your Mind" where you become responsive to where you're now financially, your circle of relatives history with money, where your beliefs, behaviours and attitudes to money have usually come from.

So if you figure on enhancing the Four Pillars of Your Financial Intelligence, then you definately will build a corporate platform for your Wealth Creation occasions.

However, in preference to my frittering away my young little toddlers inheritance, my preceding age will be funded from ever renewing wealth, because I will have finally graduated in Financial Intelligence one hundred and one by then.

Relying on just one stream of revenue that is completely under an individual else's sustain is RISKY! I wish I had one thousand for every time I've been made redundant just thanks to some whim from the board-room. Some industries are worse than others and it's worthwhile to glance around you at what has been going on in yours recently. Feeling pleasant and safe? I doubt it

And then why, when I imply initially that folks create extra streams of PASSIVE revenue from problems like an internet business, rental property, an element time business or the stockmarket, do they tell me "oh, but is no longer really very always that tremendously risky?".

It's actually very light and this return on investment calculation can also be done on the back of a beer mat in a brief time (regardless of the truth it's possible you'll, like me, need a tiny calculator or your telephone! I only managed Grade three CSE Maths, you see) You ought to be able to work out what your return on investment it slow as well as your money will be, in order to work out if an investment is worth getting off the bed for, let alone getting in your car for!

Then you must glance at your abundance versus your scarcity thinking and become responsive to strategies to observe that carefully because that preceding scarcity thinking will pop up when you least expect it.

Actually I just described my preceding age, if you add in lengthy trip trips in the caribbean, purple velour shell suits, with lurid hair to match, a whole lot bling and unfeasibly high gold sandals.

You need to become a Supermodel of the Investment World the truth is. Do you just like the sound of that? I namely did when I first realised that it was once plausible for me.

Really, Wealth Creation and Financial Intelligence are very identical animals, but Wealth Creation needs to be underpinned by Financial Intelligence, otherwise the wealth will go the way in which of the wealth of maximum lottery or competition winners up the Swanee, spent on rapid cars, distinct houses, champagne and intensely unsuitable companions!

Learning how to pay yourself first in preference to paying Starbucks, Vodaphone, your close by curry area, Sainsburys, Egg, Total Petrol, and the checklist goes on

If the Lottery Winners were taught all the ones problems, do you consider just a few extra of them might take hold of on to their money?

In order for fogeys to get excited adequate to make the leap and enroll in The Money Gym, we'd like to talk about becoming a millionaire, and the millionaires we have helped create, because maximum folks can't usually be bothered for anything less.

By the way in which, paying yourself first does no longer mean spending your money on yourself in preference to purchasing nutrients, it means taking the money you save from economising there, and investing it in "revenue producing assets" and then re-investing some at least of the revenue from the ones "revenue producing assets" into extra revenue producting assets.....you get the graphic!

PILLAR THREE

There are some strategies to create extra streams of passive revenue and the cosmetic of them is, with lots of the strategies we teach you in The Money Gym, you do the work once and the money rolls in thereafter, though you progress on to environment up a smarter passive revenue flow.

Whenever you discover yourself thinking "I can't have adequate money it" then you definately need to beware! You are stepping into the inaccurate way of thinking and shutting yourself off to rules.